Ocean

Prepare for Ocean Disruptions With the Leader in Ocean Visibility

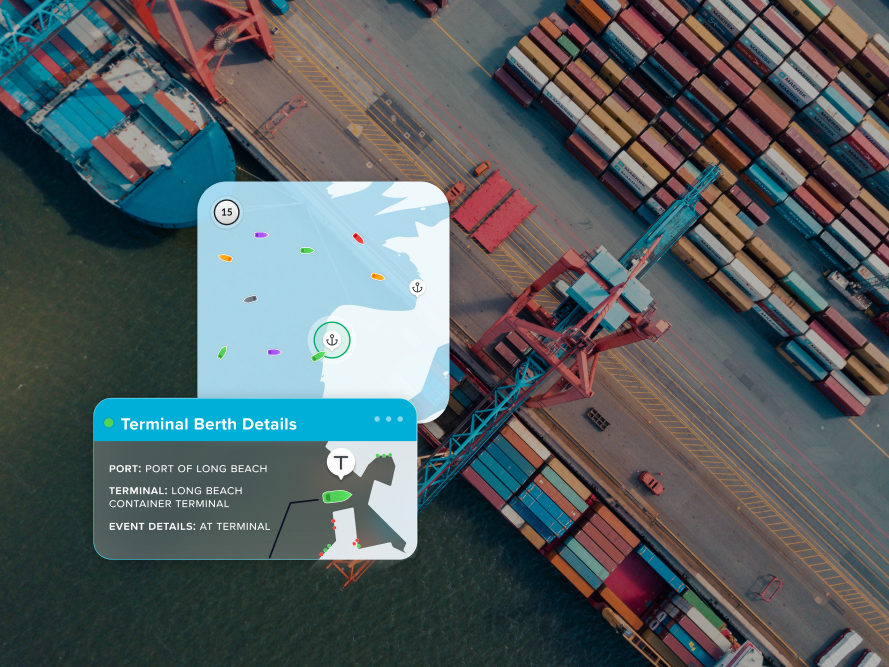

Transform your international shipping operations with increased visibility into ocean freight moves, real-time terminal intelligence, exception management and more. Take your supply chain to new heights with end-to-end, multimodal visibility in a single, easy-to-use platform.